Resolve Your Tax Liability Today

Safe, Secure, No Obligation

I acknowledge that by clicking “CALL NOW” I will be contacted by a 20/20 Tax Resolution Inc. representative via SMS/MMS text messages and/or phone.

By doing so I waive any registration to any state, federal or corporate Do Not Call registry. I understand message & data rates may apply.

This information will be transmitted securely and will not be sold to any third parties.

We Get Results

At 20/20 we understand that when it comes to a resolution with the taxing authorities that there is no one size fits all resolution strategy. We will fully investigate your specific situation and provide you with the guidance needed to resolve your liability.

Not ready to talk to someone?

Let us email you some general information about our process.

"*" indicates required fields

Choosing 20/20 Tax Resolution

You Get Your Life Back

We notify the tax authorities that you now have professional representation. We take over your case from this point forward so you can get back to work.

We Go to Bat for You

Once you approve the strategy, our tough-nosed negotiators ensure your rights are protected and fight to secure the best resolution possible for you.

We Dig in to the Details

We establish the true facts of your case, double check the accuracy of taxes, penalties and interest, and create your custom resolution strategy.

Penalty Abatement

At the right time in your case's resolution process, we request a penalty abatement on your behalf by applying the tax authority's reasonable cause criteria. The timing and method of doing this is crucial.

Success

We outline the exact terms of your resolution, monitor your account for any post-resolution errors and give you a plan that will keep you out of tax trouble moving forward.

We keep you informed at every step of the process. You are always in control.

We Are Committed To Finding Solutions

Success Stories

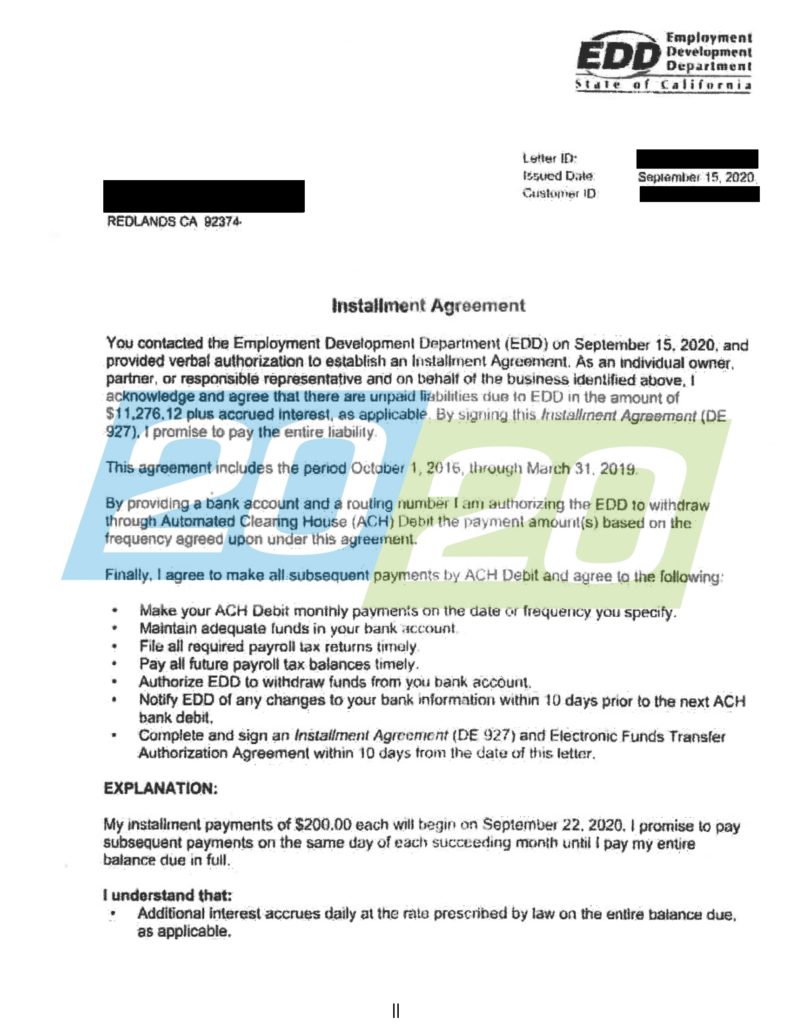

State Payment Plan — 2020-09-15 State Accepts Payment Plan in Redlands, CA

20/20 Tax Resolution successfully negotiated a Payment Plan with the California Employment Development Department for a client in Redlands, California. 20/20 Tax Resolution negotiated payments of $200 per month on a liability totaling over $11,000. Please click the thumbnail to the right for more details.

State Payment Plan — 2020-07-13 State Accepts Payment Plan in Palm Desert, CA

20/20 Tax Resolution successfully negotiated a Payment Plan with the California Employment Development Department for a client in Palm Desert, California. 20/20 Tax Resolution negotiated payments of $388 per month on a liability totaling over $7,000. Please click the thumbnail to the right for more details.

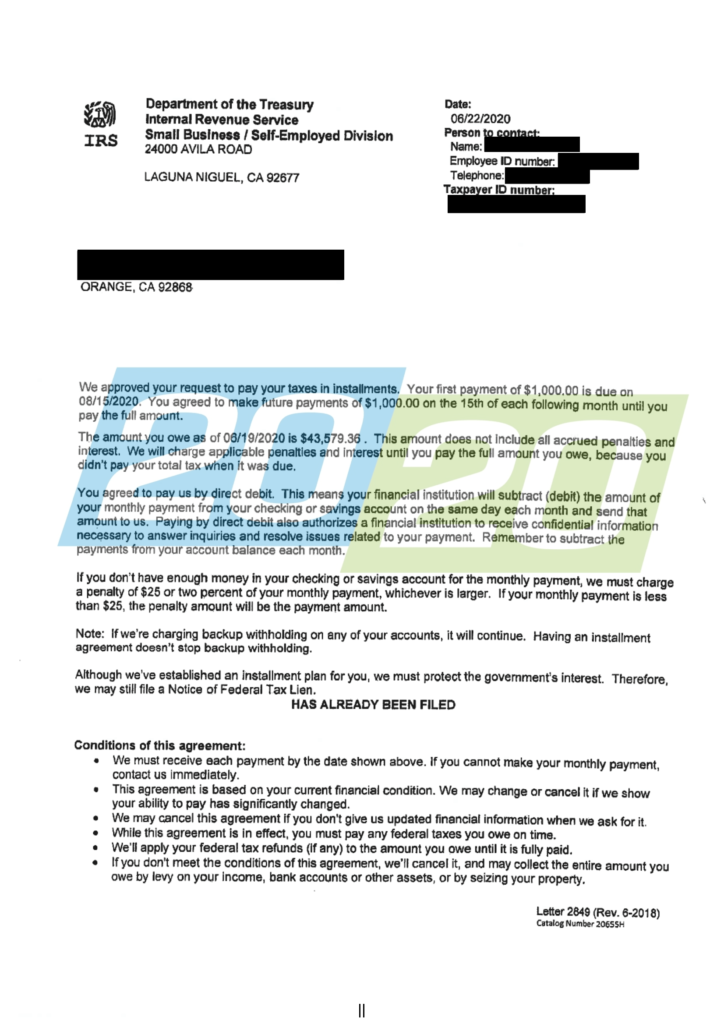

IRS Installment Agreement — 2020-06-22 IRS Accepts Installment Agreement in Orange, CA

20/20 Tax Resolution was successful in their negotiations of an Internal Revenue Service payment agreement for a client in Orange, California. 20/20 Tax Resolution negotiated payments of $1,000 monthly on a liability totaling over $43,000. Please click the thumbnail to the right for more details.

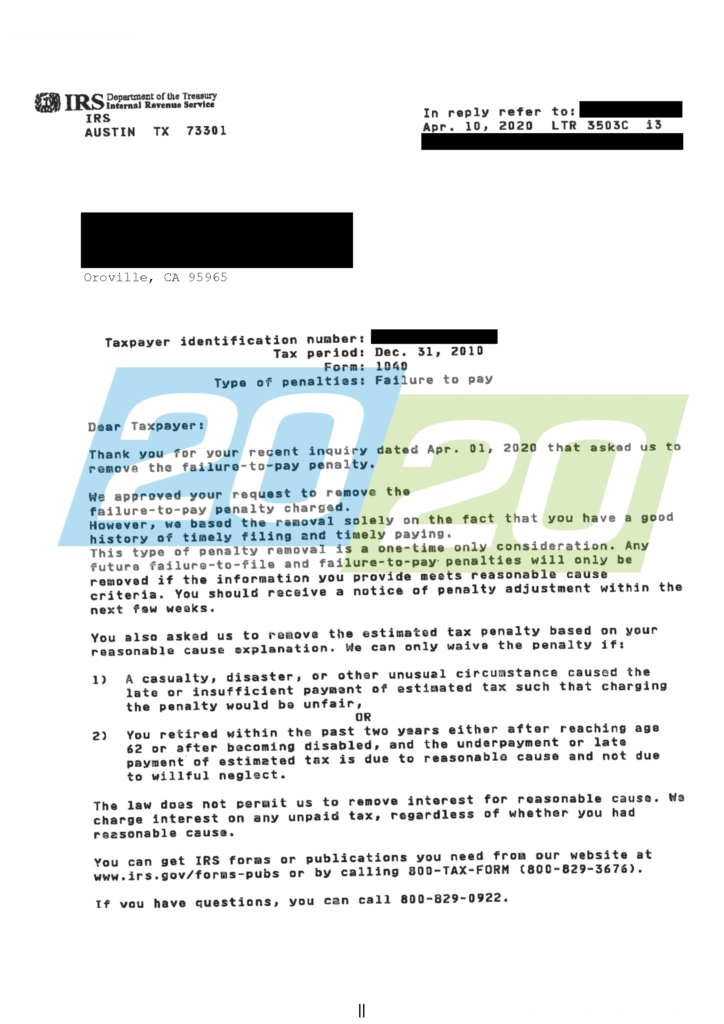

IRS Penalty Abatement — 2020-04-10 IRS Accepts Penalty Abatement Request in Oroville, CA

20/20 Tax Resolution successfully negotiated a Penalty Abatement with the IRS for a client in Oroville, CA. Please click the thumbnail to the right for more details.

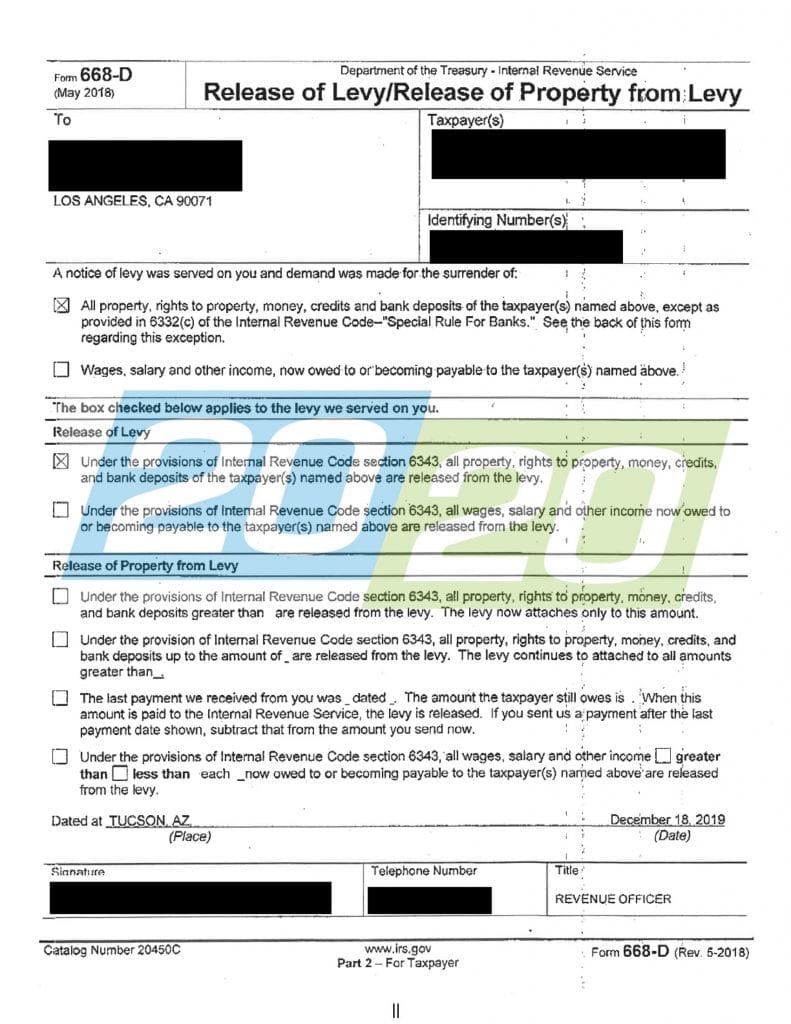

IRS Levy Release — 2019-12-18 IRS Releases Levy in Los Angeles, CA

20/20 Tax Resolution successfully negotiated a Levy Release with the IRS for a client in Los Angeles, California. Please click the thumbnail to the right for more details.

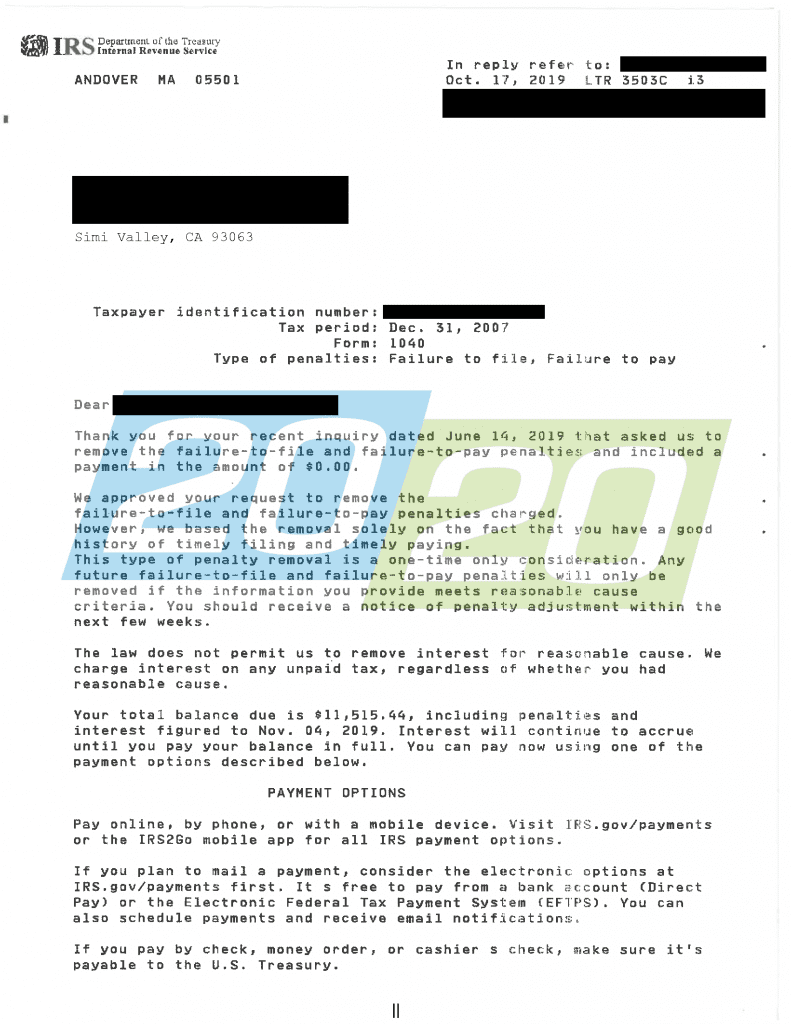

IRS Levy Release — 2019-10-17 IRS Accepts Penalty Abatement Request in Simi Valley, CA

20/20 Tax Resolution successfully negotiated a Penalty Abatement with the IRS for a client in Mineral Point, Wisconsin. This client owed over $11,000 in back taxes. Please click the thumbnail to the right for more details.