Notice of Intent to Levy

For most people getting a letter from the IRS triggers instant stress unless they’re expecting a refund check. If you’re already struggling and are behind on paying taxes one of those letters may be an IRS Letter 1058, also known as a Final Notice of Intent to Levy.

This letter is the IRS officially telling you that they plan to seize your assets. The IRS manual states that the purpose of the Final Notice of Intent to Levy is to act as a final warning that failure to respond could result in immediate enforcement. If the IRS takes action they may put levies on your bank accounts, accounts receivable, as well as wage garnishments and seizures.

As bad as it sounds, not all hope is lost if you receive a notice of intent to levy. The good news is there are some easy steps you can take to stop the IRS from taking action on the levy notice.

In this article, we’ll take an in-depth look at what an IRS levy notice is, how to respond and stop it, and what you can do to ensure you never need to worry about it again.

Table of Contents

- What is a Notice of Intent to Levy?

- What to Expect in a Notice of Intent to Levy?

- What Are the Different Notices the IRS Sends Before Seizing Your Assets?

- Can You Appeal a Letter 1058?

- When Should you Consider Appealing a Tax Levy?

- The Employee Retention Tax Credit

- What is the Process for Filing a Tax Levy Appeal?

- What Assets Can the IRS Seize with a Tax Levy?

- How to Respond to an IRS Final Notice

- Tax Levy Help

What is a Notice of Intent to Levy?

An IRS Intent to Levy Notice is only sent out when you’re seriously delinquent on owed taxes and have made no effort to resolve the situation. The IRS must provide you a notice in advance before seizing property, garnishing wages, putting levies on your bank accounts, and other assets. Under the law the IRS must do the following at least 30 days before taking action on seizing any assets:

- Provide written notice of the intent to levy

- Explain the reason for the levy, the seizure process, and the taxpayer’s options

- Deliver the notice in person or send it via registered mail

Keep in mind there are some exceptions to the 30-day rule: state tax refunds, if the IRS suspects tax collection is in jeopardy, Disqualified Employment Tax Levies, and federal contractor levies.

As overwhelming as receiving an IRS Intent to Levy Notice can be, remember you have 30 days to appropriately respond and stop it from going into action.

What to Expect in a Notice of Intent to Levy?

The notice will list the tax type (i.e 1040), tax period, unpaid amount from prior notices, additional penalty, additional interest, and the amount owed. Along with the notice, the IRS will also include Publication 594: The IRS Collection Process and Publication 1660: Collection Appeal Rights.

You have the option to submit an appeal in response to the Final Notice of Intent to Levy through a Request for Collection Due Process or Equivalent Hearing. The tax modules included on the Final Notice of Intent to Levy can be included on the appeal request. Under certain conditions, prior tax modules that are not included on the notice may also be included within the appeal request. Such tax modules would fall under the Equivalent Hearing provisions

What Are the Different Notices the IRS Sends Before Seizing Your Assets?

There are a number of different types of notices the IRS may send informing you they are considering taking action on asset seizure.

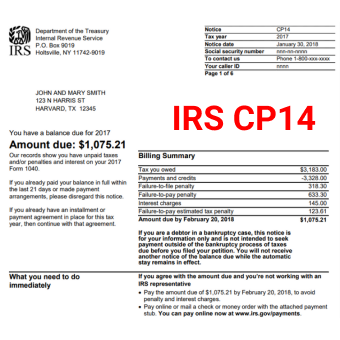

IRS CP14 Notice

Notice CP14 is the first letter you’ll receive from the IRS when you have a balance due for owed taxes. The notice will include basic information like the tax year or period for which you owe, the amount of taxes, due date, failure to pay penalty, and interest. It will also show the deadline for submitting your payment.

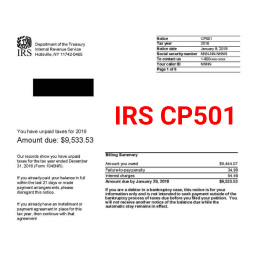

IRS CP501 Notice

If you fail to respond to Notice CP14 you might receive a Notice CP501. This is just another straightforward notice informing you that you need to pay your outstanding tax bill. It will contain the same information you received in the CP14 and a warning about what can happen if you don’t pay your tax debt.

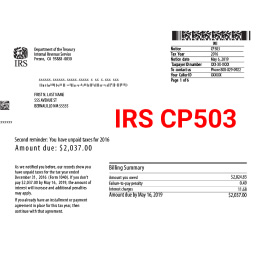

IRS CP503 Notice

The CP503 Notice is typically the third notice you’ll receive in regard to owed taxes. If you’re a business, this may be the second notice of four. The letter basically restates the same information in the CP501 Notice. By sending multiple notices the Internal Revenue Service is establishing a record to show they did their due diligence in letting you know what you need to do to satisfy your tax liability before they take action on a levy.

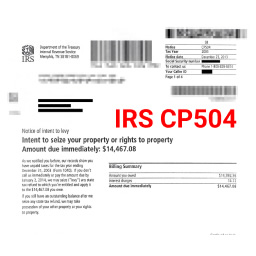

IRS CP504 Notice

If you receive a CP504 Notice your situation has escalated to the point of seizure. IRS Notice CP504 lets you know the IRS intends to begin seizure unless you pay the amount due immediately. The notice also explains the denial or revocation of your United States passport. The FAST Act legislation prohibits the State Department from issuing or renewing a passport to a seriously delinquent taxpayer.

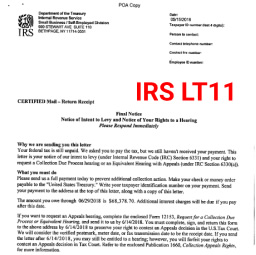

IRS Letter 1058

A Letter 1058 is your final notice to take action on remedying your tax liability before the IRS exercises its right to seize your assets through a federal tax lien. This letter is serious and should not be ignored. It’s the IRS letting you know that you officially have 30 days to respond appropriately.

Can You Appeal a Letter 1058?

If you don’t agree with the amount listed or the proposed collection action in Letter 1058, you do have a legal right to appeal and the right to a hearing. To initiate that process you’ll need to complete Form 12153 and request a Collection Due Process or Equivalent Hearing.

The IRS must receive Form 12153 within 30 days or your appeal rights will be limited.

The 30 days start on the date the Letter 1058 was issued, not on the date you received it. The deadline will be noted in the letter.

When Should you Consider Appealing a Tax Levy?

If you did not appeal your Letter 1058 and levy action has begun there are still other appeal rights. You have the right to appeal a tax levy under the law, but it’s not something you should take lightly. Here is a list of the most common reasons individuals might choose to appeal.

Your taxes are paid in full:

This one is easy. If by chance, the IRS made a mistake and didn’t record your payment, you should start the appeals process immediately.

You’re already making payments via an installment agreement:

If you’re engaged in an IRS-approved installment agreement, you should be considered in good standing with the IRS. If you’ve received a levy notice after the installment agreement is in effect, it’s a mistake, and you should appeal.

You’ve submitted an offer in compromise:

If you’ve applied for an offer in compromise, the IRS is not allowed to levy assets until it reviews the offer. If you’ve met your submission deadline, but the IRS has started seizing assets you should appeal.

The IRS made an error:

The IRS must follow strict procedures before taking action on a tax levy. If they missed a step along the way, you can appeal.

You are filing for bankruptcy:

Filing for bankruptcy puts a halt on all collection activity, including IRS collections. If the IRS sends a notice of intent to levy during your bankruptcy, the levy should be voided. Your bankruptcy attorney or tax professional can help you appeal.

Statute of limitations has expired:

The IRS has a limited time to collect owed taxes. Typically, it’s 10 years. After the statute of limitations has expired the IRS no longer has a right to levy, and you can appeal.

We Are Committed To Finding Solutions

What is the Process for Filing a Tax Levy Appeal?

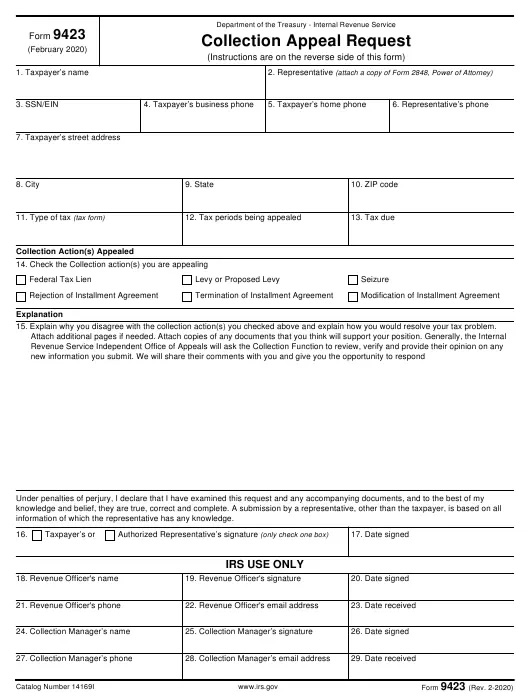

The process depends on the current status of your taxes owed and the nature of the appeal. If your case has been assigned to an IRS Revenue Officer, you will first notify the officer of your decision to appeal. If the officer does not agree with your reason to appeal, you’ll talk with the officer’s manager. If the manager also disagrees, you will have 48 hours to file a Collection Appeal Request IRS Form 9423 (CAP).

However, if your case has been assigned to the Collections division, you will first need to contact them using the number listed on the official notice that you received from the IRS. If denied after explaining your reasons, you will then notify the Collections manager of your intent to file Form 9423. It should be postmarked and mailed within three business days after your discussion with the Collections Manager.

What to Expect after Filing Form 9423

The first thing you’ll notice is that the IRS will stop any collection actions until the appeal has been resolved. The only reason they would not stop is if they have reasonable cause that you’ll dispose of your assets.

The IRS will schedule a telephone conference with you within several days of reviewing your appeal. During the conference, you may choose to represent yourself, or you can hire an attorney or other certified tax professional.

What Assets Can the IRS Seize with a Tax Levy?

- Property (cars, homes, personal property)

- Rights to property

- State tax refund

- Commissions

- Bank account funds

- Social security benefits

- Wages earned from work

- Employee travel advances

- Retirement benefits

- Contractor or vendor payments that are due to you

How to Respond to an IRS Final Notice

Receiving a Letter 1058 should get your attention. It’s a final warning before the IRS exercises its right to start seizing your assets. The good news is you have 30 days from the issue date to make things right, and you have options beyond just paying the full balance.

What the IRS wants most is engagement. If you’re willing to show them you’re trying to do the right thing, good things can happen, and your assets won’t be seized.

If you’re able to pay your entire balance that’s the easiest way to make the IRS go away. Once you make the payment, the IRS will immediately stop any collection activities.

However, most people who have received a Letter 1058 are in that position because they don’t have the money to pay in full. Don’t worry, the IRS is usually willing to work with individuals that demonstrate effort and good communication. Getting help from a licensed tax professional is ideal because they can help you understand your options and the best path forward.

If you can’t pay in full some of the options you can consider include an installment agreement, offer in compromise, CNC Status, or Innocent Spouse Relief.

Installment Agreement

Installment Agreement

An installment agreement is basically a payment plan. You’ll work with the IRS to set up a payment plan that you can afford. An installment agreement may also reduce the failure-to-pay penalty by 50 percent, but you’ll still need to pay interest. If you’re able to keep up with the payment agreement, the IRS will not act on the proposed levy.

Offer in Compromise

Offer in Compromise

An Offer in Compromise is a negotiation to settle your taxes for less than you owe. The IRS doesn’t love to offer this solution, but in some cases it’s possible. With that said you do have a chance as the IRS accepts just over 30% of Offers in Compromise. During the offer review collection activity will stop. Of course, If the IRS approves an Offer in Compromise and you pay, the debt is resolved.

CNC Status

CNC Status

CNC Status is also known as a hardship status or Currently Not Collectible status. With this agreement, the taxpayer provides a collection information statement to the IRS proving that if the IRS collected the owed taxes it would create financial hardship.

Innocent Spouse Relief

Innocent Spouse Relief

In an Innocent Spouse Relief case, one spouse would show that a current or former spouse is solely responsible for the tax amount owed. If the IRS agrees, then the responsible spouse would take on the entire liability.

Tax Levy Help

If you’ve received a Final Notice of Intent to Levy, you can work directly with a Revenue Officer or the Collections Division and try to reach a resolution. If you’re able to reach a formal agreement to resolve your Federal tax liability, the IRS will cease its collection efforts.

However, if a formal agreement has not been reached within 45 days of the date of the notice, the IRS will almost always levy. Learn more about stopping a tax levy by downloading our free guide.

If you want to explore all of your options, you can speak directly to one of our tax experts, today. A tax resolution specialist brings the same knowledge and skills as a tax attorney without the high fees.

We understand the threat or notification of a levy can feel overwhelming, but you still have time to stop it. For the best outcome, a solid plan and strategy should be put in place as soon as possible.

If you’re facing a tax levy the easiest and fastest way to get through it with the least amount of pain is to let the tax pros at 20/20 guide you through the resolution. Speak to one of our tax resolutions experts about your IRS tax levy situation, and get a free consultation today.