In the realm of taxes, the phrase “for better or for worse” takes on a new significance. The IRS holds both individuals in a married couple responsible for the entirety of the tax liability when filing a joint tax return. But what happens when one spouse is unaware of mistakes or intentional misstatements made by the other? The consequences can be financially devastating, as the “innocent” spouse may find themselves ensnared in penalties, interest charges, and other tax liabilities that they did not knowingly incur. Enter Innocent Spouse Relief, a provision that allows for one spouse to be released from joint liability under specific conditions.

The concept of Innocent Spouse Relief acknowledges the complex emotional and financial dynamics that exist within marriages. Whether due to divorce, separation, or ongoing marriage issues, individuals may find themselves unfairly burdened with tax debts incurred by their partner. Navigating the labyrinthine world of tax law when you owe tax to secure this relief can be overwhelming, but the ramifications of not doing so can be ruinous.

This article aims to demystify the process, providing a comprehensive guide on the criteria, application process, and potential outcomes of seeking Innocent Spouse Relief. Because when it comes to paying additional taxes, “til death do us part” shouldn’t mean being shackled to your spouse’s tax liabilities indefinitely.

Table of Contents

- What is Innocent Spouse Relief?

- What are the Types of Innocent Spouse Relief?

- What are the Benefits of Innocent Spouse Relief?

- How to Qualify for Innocent Spouse Tax Relief?

- How to Apply for Innocent Spouse Relief

- What is the difference between IRS Form 8857 and 8379?

- How Can a Tax Relief Firm Help with Innocent Spouse Relief?

What is Innocent Spouse Relief?

Innocent Spouse Relief is a tax provision designed by the Internal Revenue Service (IRS) to protect a spouse from being held financially responsible for the misdeeds or mistakes on a joint tax return, for which they had no knowledge or involvement. Simply put, it’s a legal avenue that can extricate an individual from the shared tax burden when their spouse or former spouse failed to report income, claimed improper deductions, or engaged in outright fraud. This relief option aims to ensure that an individual is not penalized for the actions of their partner when those actions lead to an incorrect tax bill.

The significance of Innocent Spouse Relief becomes apparent when considering the severity of penalties, interest, and other financial repercussions that can accrue from tax liabilities. A taxpayer who qualifies for this relief will be spared from paying tax, interest, and penalties for which their spouse or former spouse should justly be held responsible. Additionally, in some cases, the IRS will refund amounts already paid towards the liability. It’s crucial to note that applying for Innocent Spouse Relief is a time-sensitive process, with various conditions and stipulations that must be met. While not a blanket amnesty, this form of relief serves as an important safety net for those ensnared in unjust financial turmoil due to their spouse’s actions.

What are the Types of Innocent Spouse Relief?

The IRS offers three primary forms of Innocent Spouse Relief, each catering to different sets of circumstances and requirements. Understanding these types can help individuals better navigate their options for relief from shared tax liabilities.

Traditional Innocent Spouse Relief

This is the most commonly sought-after form. To qualify, the taxpayer must prove they were unaware of the erroneous items leading to an understated tax liability. If granted, this relief entirely separates the innocent spouse’s tax liability from that of their partner for the tax year in question.

Separation of Liability

In this arrangement, the IRS apportions the understated tax (plus interest and penalties) between the two spouses based on various factors, such as their individual income. Separation of Liability is often pursued in instances of divorce or legal separation but can be available to those still married under certain conditions.

Equitable Relief

If a taxpayer doesn’t fit the criteria for the other two types, Equitable Relief may still be an option. This category is broader and considers whether it is fair to hold the innocent spouse responsible for the understated or underpaid tax, given all the facts and circumstances. Factors like spousal abuse, financial hardship, or deception by the offending spouse can weigh heavily in favor of granting this relief.

What are the Benefits of Innocent Spouse Relief?

Innocent Spouse Relief comes with it a multitude of benefits that extend beyond the immediate financial relief. First and foremost, being granted this relief absolves the innocent spouse from responsibility for paying the disputed tax, penalties, and interest accrued due to their partner’s errors or misconduct. In some cases, it can even lead to the refund of money already paid towards the tax liability.

Innocent Spouse Relief can alleviate emotional stress and psychological burden. The financial strain from an unexpected tax debt can significantly impact mental health, contribute to the breakdown of familial relationships, and even lead to chronic stress. Successfully navigating the relief process can be emotionally liberating.

Qualifying for Innocent Spouse Relief can act as a form of protection against future financial repercussions. Unresolved tax issues can lead to severe consequences such as wage garnishment, property seizure, and damage to one’s credit score, affecting one’s ability to make essential life purchases like a home or car. Being granted Innocent Spouse Relief helps protect against these life-altering impacts.

Lastly, this relief fosters fairness and equity in the taxation system. It acknowledges the reality that not all spouses are equally responsible for errors on a joint return and helps ensure that individuals are not unjustly penalized for their spouse’s mistakes or deceit.

How to Qualify for Innocent Spouse Tax Relief?

Qualifying for Innocent Spouse Tax Relief involves meeting a set of criteria outlined by the IRS. The process can be complex and time-sensitive. Here’s a roadmap to help you understand the eligibility requirements and the steps to take.

File a Joint Tax Return

The first step for eligibility is that you must have filed a joint tax return with your spouse or ex-spouse for the tax year in question. Innocent Spouse Relief relieves only applies to liabilities arising from a joint filing.

Identify Erroneous Items

There should be a tax liability due to erroneous items attributed to your spouse. These could range from unreported income, incorrect deductions, or fraudulent activity. You must be able to clearly identify these issues and prove that they were not your doing.

Lack of Knowledge or Participation

One of the core elements is that you were unaware and did not have reason to know of any discrepancies when you signed the tax return. You must provide evidence, such as communications or lack thereof, that shows you were unaware of your spouse’s financial misrepresentations.

Timely Filing

You generally have to file IRS Form 8857, “Request for Innocent Spouse Relief,” no later than two years from the date the IRS first attempted to collect the tax from you. The timing varies depending on the type of relief sought, so it’s crucial to act swiftly.

Current Status

Your relationship status with your spouse can also affect eligibility. While being divorced or separated can make the process smoother for certain types of relief, you can still qualify if you’re married, although additional evidence may be necessary.

Financial Hardship

For Equitable Relief, demonstrating that you’d suffer significant financial hardship if held responsible for the debt could help your case. Documentation of income, expenses, and assets will be crucial here.

Good Faith

The IRS will evaluate whether it would be “inequitable” or unfair to hold you liable for the tax debt. Factors such as whether you received a significant benefit from the understated tax, or if you’ve been a victim of spousal abuse, can tip the scales in your favor.

Get a free consultation

We Are Committed To Finding SolutionsLearn MoreHow to Apply for Innocent Spouse Relief

Applying for Innocent Spouse Relief is a process that requires attention to detail, adherence to specific timelines, and meticulous documentation.

1. Collect Necessary Documents

Before starting, gather all pertinent financial records, tax returns, and any evidence that could support your case, such as correspondence regarding the unreported income or erroneous deductions.

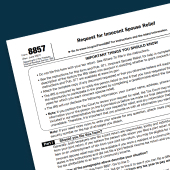

2. Fill Out IRS Form 8857

The primary form used to request Innocent Spouse Relief is IRS Form 8857, “Request for Innocent Spouse Relief.” It’s crucial to complete this form accurately and comprehensively, as this will serve as the basis for the IRS to evaluate your case.

3. Attach Supporting Documents

Attach any documentation that substantiates your claims, whether it’s proof of your unawareness of the tax liabilities, evidence of deception or abuse by your spouse, or documents that outline your financial situation. This can help strengthen your case significantly.

4. Submit the Application

4. Submit the Application

Once your form and all supporting documents are prepared, you can submit them to the IRS. Pay close attention to deadlines. Typically, you must submit Form 8857 within two years from the first collection attempt made by the IRS, although there are exceptions.

5. Interview Phase

5. Interview Phase

After submission, the IRS might conduct interviews with both spouses to verify the claims. This step may be especially pertinent in cases involving deception or abuse, so it’s vital to be prepared and possibly consult a tax attorney or advisor for assistance.

6. Wait for Initial Determination

6. Wait for Initial Determination

The IRS will review your application and issue an initial determination. This could take anywhere from a few months to over a year, depending on the complexity of the case.

7. Appeal if Necessary

7. Appeal if Necessary

If the IRS denies your request, you generally have the right to appeal the decision. This would require additional documentation and possibly legal representation, depending on the circumstances.

8. Stay Compliant

8. Stay Compliant

Throughout this process, continue to comply with all other tax obligations. Failure to do so can adversely affect your application for Innocent Spouse Relief.

9. Consult Professionals

9. Consult Professionals

Given the legal and financial intricacies involved, consulting a tax relief firm that specializes in tax issues can offer invaluable guidance.

We Are Committed To Finding Solutions

Learn More

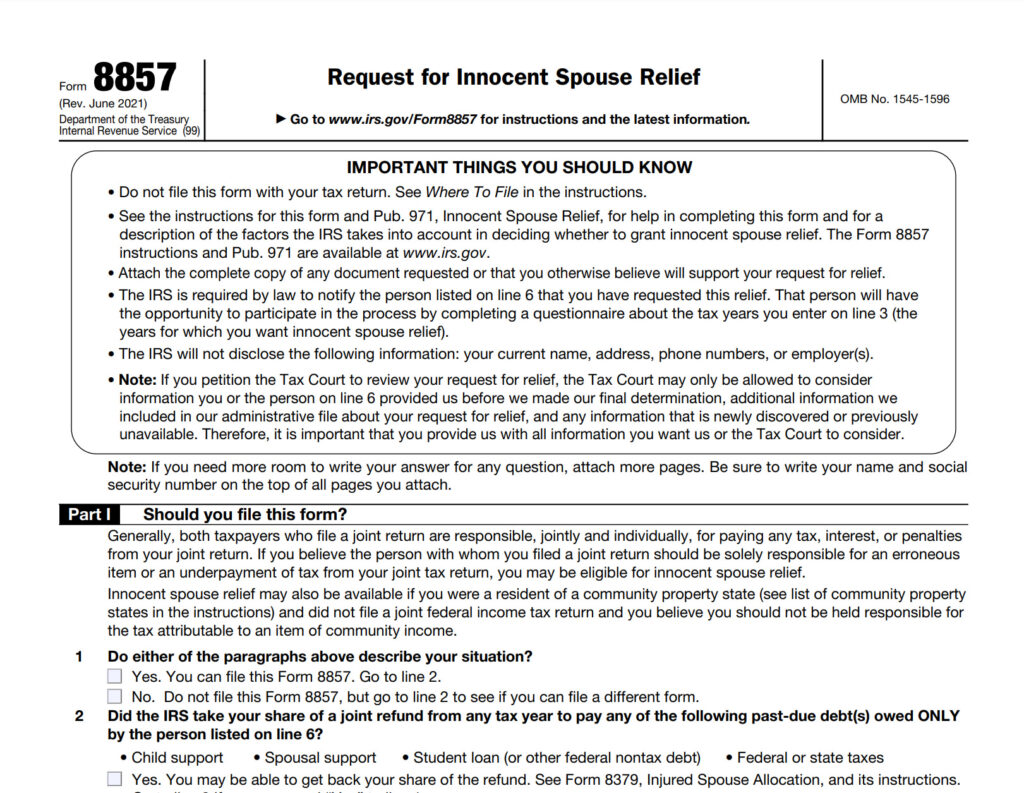

What is the difference between IRS Form 8857 and 8379?

IRS Forms 8857 and 8379 serve different purposes and are used in distinct scenarios, though both are related to issues involving joint tax liabilities.

IRS Form 8857: Request for Innocent Spouse Relief

Purpose

Purpose

This form is used to request relief from joint tax liability in cases where a current or former spouse failed to report income, reported income improperly, or claimed wrongful tax deductions or credits. It is meant to separate the tax responsibilities of the two individuals involved.

Eligibility

Eligibility

To use this form, you must generally meet specific criteria such as lack of knowledge about the understated tax, among other factors.

Scope

Scope

This form can apply to various types of additional taxes, penalties, and interest, not just the understated income or improper credits and deductions.

Timeline

Timeline

Generally, you must file Form 8857 within two years from the date the IRS first attempted to collect the tax from you. However, timelines may vary depending on the type of relief being sought.

Outcome

Outcome

If the IRS approves your request, you may be relieved of all responsibility for paying tax, interest, and penalties related to the joint tax return for that specific year.

Speak With a

Licensed Tax

Professional

Learn MoreIRS Form 8379: Injured Spouse Allocation

Purpose

Purpose

This form is used when a joint tax refund is or could be applied to a past financial obligation of one spouse (such as child support, student loan debt, or past-due federal debts), and the “injured” spouse wants their share of the refund.

Eligibility

Eligibility

To be eligible for injured spouse relief, the injured spouse must have made and reported tax payments or had tax credits, such as earned income credit or withholding, applied to the joint return.

Scope

Scope

This form is exclusively for allocating refunds and doesn’t provide joint tax liability relief or separate the liabilities of each spouse.

Timeline

Timeline

You can file Form 8379 along with your joint tax return, or you can submit it separately afterward if you notice your refund has been applied to the other spouse’s debts.

Outcome

Outcome

If approved, the IRS will allocate part of the joint refund to the injured spouse, separate from the debts of the other spouse.

While both forms are designed to address issues in joint tax filing situations, they are used in different scenarios and have different implications. Form 8857 is for separating tax liabilities, while Form 8379 is for allocating a joint refund when one spouse has specific types of debts.

How Can a Tax Relief Firm Help with Innocent Spouse Relief?

Navigating the complexities of the tax code, especially when it involves sensitive issues like Innocent Spouse Relief, can be a daunting experience. This is where a tax relief firm like 20/20 Tax Resolution can be invaluable. Staffed with experts in tax law, these firms can offer a plethora of services and advantages to help guide you through the process and enhance your chances of success.

Expert Assessment

20/20 Tax Resolution can meticulously evaluate your specific situation to determine if you qualify for any form of Innocent Spouse Relief. They can assess which type of relief—Traditional Innocent Spouse Relief, Separation of Liability, or Equitable Relief—best suits your case based on your circumstances and eligibility criteria.

Documentation & Filing

One of the most complicated aspects of applying for relief is gathering the necessary documentation and filing the paperwork accurately and within deadlines. Tax professionals can help you compile all required documents, from financial records to correspondence that can prove your unawareness of the tax discrepancies.

Strategic Planning

Tax relief firms have experience dealing with a myriad of cases and can design a strategy tailored to your situation. They can help you anticipate potential challenges or objections from the IRS, ensuring that you’re prepared for any questions or interviews that may arise during the evaluation process.

Negotiation with the IRS

With extensive knowledge of tax law and IRS procedures, 20/20 Tax Resolution is well-equipped to negotiate on your behalf. Whether it’s communicating with IRS representatives or challenging their initial determinations, professional intervention can often lead to more favorable outcomes.

Appeal Assistance

In cases where the initial application is denied, a tax relief firm can assist with the appeals process. They can help you understand why your request was rejected, what additional evidence may be needed, and how to present your case in the most compelling manner during the appeals process.

Peace of Mind

Beyond the technical and legal aspects, having an experienced advocate can provide emotional relief. It gives you the assurance that you’re not navigating this intricate, potentially stressful process alone.

Compliance and Future Planning

Additionally, a tax relief firm can offer advice on how to stay compliant with tax laws moving forward, thereby preventing similar issues in the future.

Engaging the services of a tax relief firm can be a wise investment when you’re seeking Innocent Spouse Relief, providing expert guidance that can drastically improve your likelihood of a successful outcome.

20/20 Tax Resolution are nationwide go-to experts when it comes to IRS tax resolution help. We’re a network of experts and enrolled agents that serve individuals and businesses nationwide. 20/20 Tax Resolution has helped over 32,000 businesses and individuals reach successful resolutions with their IRS and state tax liabilities.