Have you received a CP14 notice from the IRS? If you have, don’t worry, we’re going to tell you everything you need to know about it here. The CP14 Notice holds significant importance for individuals and businesses alike. Issued by the Internal Revenue Service (IRS), this notice serves as a critical communication tool to inform taxpayers about unpaid taxes or discrepancies found in their tax returns. Understanding the purpose, implications, and necessary steps associated with the CP14 Notice is essential for anyone who receives it.

In this comprehensive article, we will delve into the intricacies of the CP14 Notice to provide a clear understanding of its various aspects. By shedding light on its significance and offering guidance on how to navigate through the process, we aim to empower taxpayers with the knowledge needed to effectively respond to the CP14 Notice.

Within this article, we will explore the key elements of the CP14 Notice, including the information it contains, the reasons for its issuance, and the potential consequences if left unaddressed. We will also discuss the available options for responding to the notice and resolving any outstanding tax problems.

Whether you are an individual taxpayer or a business owner, this article will serve as a valuable resource, offering insights and practical advice to help you navigate the complexities of the CP14 Notice. So, let us embark on this journey of understanding, as we unravel the CP14 Notice and equip you with the necessary tools to navigate the path towards resolution and compliance.

Table of Contents

What is a CP14 Notice?

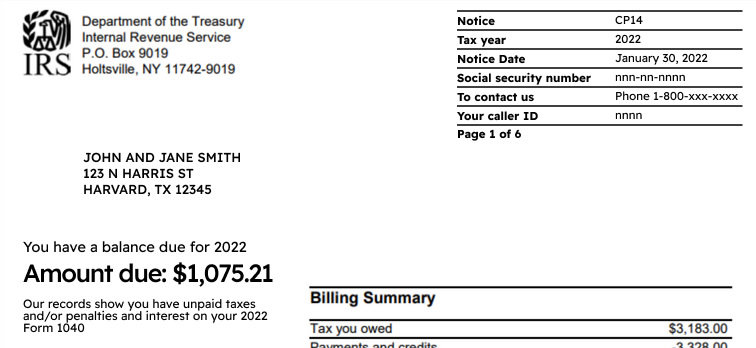

The CP14 Notice is an official communication sent by the Internal Revenue Service (IRS) to taxpayers when there are outstanding taxes or discrepancies found in their tax returns. Considered as the initial contact from the IRS regarding a specific tax issue, the CP14 Notice should be treated with utmost attention and prompt action.

When you receive a CP14 Notice, it identifies a balance due, and the difference between what is owed and paid thus far. It also could be the result of a disagreement between what’s self reported and what the IRS thinks.

In essence, the CP14 Notice contains your personal information, such as your name, address, and either your Social Security Number (SSN) or Employer Identification Number (EIN). It also specifies the relevant tax period, the exact amount of tax owed, and any associated penalties or interest.

Receiving a CP14 Notice can understandably cause concern, but it is crucial to address it promptly and appropriately. Failing to take timely action can result in more severe consequences, such as increased penalties, aggressive collection efforts, or potential legal ramifications.

Throughout the subsequent sections of this article, we will explore the CP14 Notice in greater detail, including the common reasons for its issuance, the potential implications for taxpayers, and the recommended steps to effectively address and resolve the tax issue at hand.

Why Did I Receive a CP14 Notice from the IRS?

Receiving a CP14 Notice can leave you wondering about the reasons behind its issuance. Understanding the different scenarios that can lead to a CP14 Notice is crucial for addressing the underlying tax issue effectively. Here are some common issues that can lead to a CP14 Notice:

Underreported Income

One of the primary reasons for receiving a CP14 Notice is underreported income. If the IRS detects a discrepancy between the income you reported on your tax return and the income reported by third parties, such as employers or financial institutions, they may issue a CP14 Notice to rectify the difference.

Mathematical Errors

Mistakes happen, and if the IRS identifies mathematical errors on your tax return that result in an unpaid tax balance, they may send you a CP14 Notice. These errors could be related to miscalculations, incorrect entries, or computational errors.

Missing Forms or Schedules

Failing to include necessary forms or schedules with your tax return can trigger a CP14 Notice. If you omitted important documents like Form W-2, Form 1099, or Schedule C, the IRS may send a notice to request the missing information.

Discrepancies in Deductions or Credits

If the IRS discovers discrepancies in deductions or credits claimed on your tax return, they may issue a CP14 Notice. It could be related to excessive deductions, inaccurate credits, or insufficient supporting documentation.

Failure to Pay Estimated Taxes

Taxpayers who are required to make quarterly estimated tax payments but fail to do so may receive a CP14 Notice for the unpaid amounts.

Data Entry Errors

Simple data entry errors, such as typos in Social Security Numbers or incorrect taxpayer identification numbers, can also trigger the issuance of a CP14 Notice.

It is essential to carefully review the CP14 Notice you receive from the IRS to determine the specific reason behind its issuance. By understanding the cause, you can take appropriate steps to address the issue and prevent further complications. In the following sections, we will explore the potential implications of receiving a CP14 Notice and discuss the necessary actions you should consider taking.

What Should You Do After Receiving a CP14 Notice?

You’ve received a CP14 Notice, now what do you do? You have a number of ways to respond to a CP14 Notice. The one thing you should never do is ignore it. Here are the following ways you can handle the IRS notice.

Review the Notice

Carefully read it to understand the details of the tax discrepancy, including the tax period, amount owed, and any penalties or interest accrued. Ensure that all the information provided by the IRS aligns with your records.

Verify the Accuracy

Double-check your tax return and supporting documents to verify the accuracy of the reported information. Look for potential errors or omissions that may have triggered the issuance of the notice.

Understand the Deadline

The notice specifies a due date by which you must respond or make payment. Take note of this deadline and ensure you have sufficient time to gather the necessary information and take appropriate action.

Respond to the Notice

Formulate a response to the notice within the given timeframe. This may involve acknowledging and accepting the tax liability, disputing the discrepancies, or providing additional supporting documentation. Follow the instructions provided in the notice regarding the preferred method of response.

Address the Payment

If you agree with the tax amount owed, explore the available payment options. The IRS provides various methods, such as online payment portals, installment agreements, or offers in compromise, to settle the outstanding tax balance.

Request an Abatement

In certain cases, you may be eligible to request an abatement of penalties or interest if you can demonstrate reasonable cause for the tax discrepancy or late payment. Consult the IRS guidelines or seek professional advice to determine if you qualify for penalty relief.

Maintain Documentation

Keep copies of all correspondence, responses, and supporting documents related to the notice. These records will serve as evidence and references in case of future inquiries or disputes.

Consider Professional Assistance

If you find the tax matter complex or overwhelming, consider consulting a tax professional, such as a tax resolution company. They can provide guidance, review your situation, and help you navigate through the process.

Remember, ignoring a CP14 Notice or failing to address the tax issue can lead to escalated penalties, collection actions, or even legal consequences. By taking proactive steps and engaging with the IRS in a timely manner, you can work towards resolving the matter efficiently and minimizing potential negative impacts.

Get a free consultation

We Are Committed To Finding SolutionsLearn MoreHow do I Dispute a CP14 Notice?

If you believe there is an error or disagreement regarding the tax discrepancy stated in your CP14 Notice, you have the option to dispute it. Here’s how you can initiate the dispute process:

1. Review the Notice

1. Review the Notice

Carefully review the notice to understand the specific details of the tax issue. Ensure that you have all the relevant documentation, such as your original tax return, supporting records, and any correspondence related to the matter.

2. Gather Supporting Evidence

2. Gather Supporting Evidence

Collect any evidence or documentation that supports your position. This may include receipts, bank account statements, canceled checks, or any other records that verify the accuracy of your reported income, deductions, or credits.

3. Contact the IRS

3. Contact the IRS

Reach out to the IRS using the contact information provided on the notice. You can call the phone number specified or write a formal letter explaining the nature of your dispute. Be prepared to provide clear and concise explanations, citing specific details and supporting evidence.

4. Formally Dispute the Notice

4. Formally Dispute the Notice

If needed, you may need to complete and submit Form 12153, Request for a Collection Due Process or Equivalent Hearing. This form is typically required if you wish to appeal the IRS’s decision regarding your dispute. Consult the IRS website or seek professional advice to determine if this form is necessary for your specific situation.

5. Maintain Records

5. Maintain Records

Keep copies of all communication, documentation, and correspondence related to the dispute. This will help you maintain a comprehensive record of your efforts and provide necessary evidence in case further action is required.

6. Seek Professional Assistance

6. Seek Professional Assistance

If the dispute becomes complex or challenging to handle on your own, consider consulting a tax professional, such as a tax attorney or tax resolution company. They can provide expert guidance, represent you in discussions with the IRS, and navigate the dispute process more effectively.

Remember, it is crucial to initiate the dispute process promptly and follow the guidelines provided by the IRS. By presenting a well-documented case with supporting evidence, you increase your chances of a successful resolution to the dispute and potentially overturn the tax discrepancy stated in the notice.

We Are Committed To Finding Solutions

Learn MoreSpeak With a

Licensed Tax

Professional

Learn More

What if I Can’t Pay the Amount on My CP14 Notice?

Receiving a CP14 Notice from the Internal Revenue Service (IRS) can be distressing, especially if you are unable to immediately pay the tax amount stated. However, the IRS understands that financial circumstances can sometimes make it challenging to settle the full unpaid balance upfront. Don’t worry, when you owe the IRS money, there are several options available to address the tax liability:

1. Installment Agreement

1. Installment Agreement

The IRS offers a payment plan, allowing you to pay off the tax debt with monthly payments you can pay online. Depending on the taxes owed, you may qualify for a short-term (120 days or less) or long-term installment plan. Keep in mind that interest and penalties may continue to accrue until the balance is paid in full.

2. Offer in Compromise (OIC)

2. Offer in Compromise (OIC)

An Offer in Compromise is an option for individuals experiencing significant financial hardship. It allows you to settle your tax bill for less than the full amount owed, based on your ability to pay. However, qualifying for an OIC can be challenging, and professional assistance may be beneficial.

3. Temporary Delay

3. Temporary Delay

If you are facing temporary financial hardship and cannot pay the tax amount immediately, you may request a temporary delay in collections until your financial situation improves. However, interest and penalties will continue to accrue during this period.

4. Currently Not Collectible (CNC) Status

4. Currently Not Collectible (CNC) Status

If you are experiencing severe financial hardship with no ability to pay your tax debt, you may request a Currently Not Collectible status. This temporarily suspends collection activities until your financial condition improves. However, the IRS will periodically review your situation to determine if your ability to pay has changed.

5. Seek Professional Advice

5. Seek Professional Advice

It is advisable to consult with tax group professionals, who can assess your financial situation, evaluate the available options, and guide you towards the most suitable course of action.

Remember when you owe money to the IRS, it is crucial to communicate and take proactive steps rather than ignoring the notice. Ignoring can lead to a federal tax lien and other big headaches you want to avoid. Contact the IRS or utilize their online resources to explore the available options and initiate the process of resolving your tax liability. By addressing the situation proactively, you can work towards finding a solution that aligns with your financial capabilities while minimizing the potential negative consequences of unpaid taxes.

Professional Tax Resolution Help

20/20 Tax Resolution are nationwide go-to experts when it comes to IRS tax resolution help. We’re a network of experts and enrolled agents that serve individuals and businesses nationwide. 20/20 Tax Resolution has helped over 32,000 businesses and individuals reach successful resolutions with their IRS and state tax liabilities.

The first step is contacting us for a free consultation. You tell us about your situation, and an experienced tax professional will lay out your options and the best way forward.