As the IRS states, the tax code is a complex set of laws affecting virtually every American individual and business. Last year the IRS processed over 244 million tax returns and other documents. The volume is a tribute to the voluntary tax system as well as the IRS workforce.

Undoubtedly, however, the complexity and volume of our tax system means that errors are almost unavoidable. As representation experts we do our best to find and correct those errors made by the IRS. But, that’s just one side of the equation. Every year countless taxpayers ask us what to do if they discover an error on a return that was already filed. The short answer is to not panic and correct the mistake.

Questions about your unique situation? Learn more about ways we can help or feel free to contact us at any time!

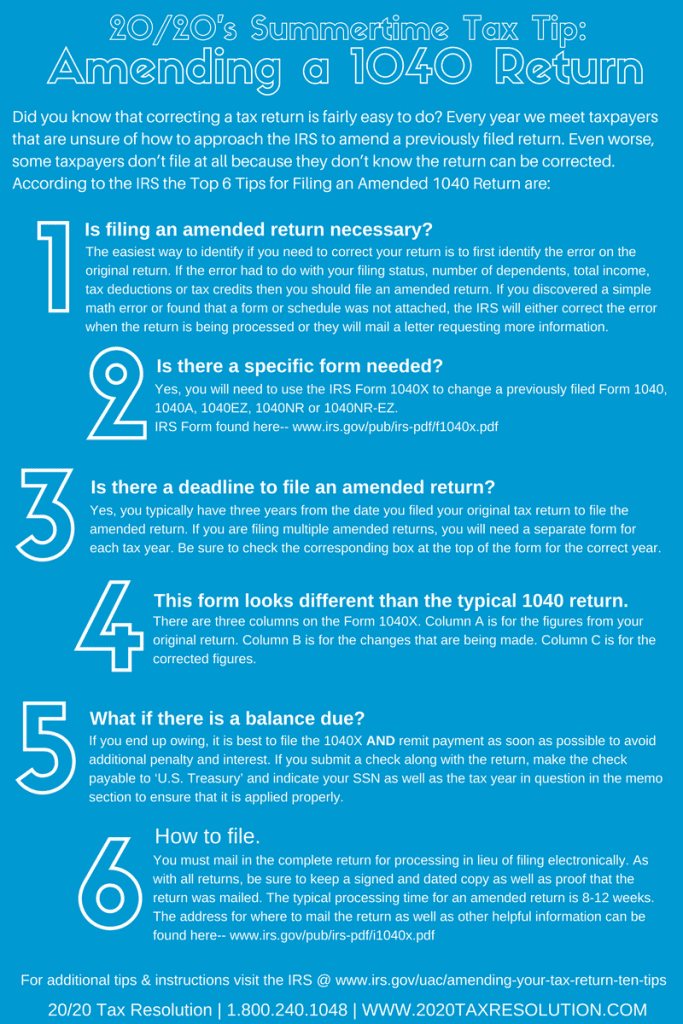

To download a high-resolution version of this infographic, please click here.