The reality is around one million taxpayers owe the IRS money at any given time. As much as the IRS attempts to collect every penny owed, it simply does not have the resources to pursue each individual debtor for years.

To lessen the load and extend some help to struggling tax debtors, the IRS offers a number of tax forgiveness options in some cases. If you owe back taxes, there’s a chance you can avoid paying the full amount by taking advantage of one of the IRS debt forgiveness programs.

As often as you see advertising about big promises of getting all of your tax debt forgiven, the truth is no outright full debt forgiveness program exists. That’s just not a thing.

However, your tax burden may be wiped clean if your situation meets very specific guidelines. For example, the IRS by law cannot collect on a debt for more than a decade. So if you’ve owed the money for at least ten years or more, it is possible that your back taxes should be forgiven. Waiting ten years is not a reasonable option for most people, but many of the IRS debt forgiveness programs lay out paths that most people can handle.

In this article, we’re going to take a deep dive into the topic of IRS debt forgiveness. We’ll dispel the myths, let you know what options are available, and define the guidelines so you can know if you qualify.

Table of Contents

IRS Tax Debt Forgiveness Options

IRS tax debt forgiveness options all based on specific circumstances. They include an offer in compromise, currently non-collectible, innocent spouse relief, installment agreements, and the Fresh Start Program.

The confusing part is that every IRS debt forgiveness program has some overlap, some of the names are just names for other programs – like the Fresh Start program – and ultimately the IRS does not ever forgive tax debt. You can’t take the term IRS debt forgiveness in the literal sense of getting your entire tax debt cleared.

However, you certainly may qualify to get a portion of your tax debt forgiven, which is the case in an offer in compromise.

The IRS Fresh Start Program

The origins of the IRS Fresh Start Program go back to 2011. It was a response to years of pressure from tax experts and consumer advocates accusing the IRS of failing to help those who were making a genuine effort to pay off their tax debt.

The idea behind the program was to help taxpayers who owed substantial back taxes an easier path to resolve their debt and move forward. Today, as much as the name is referred to, the program does not exist as a standalone program. However, the benefits that came out of the program are still available for individuals seeking IRS debt forgiveness.

To reiterate, the IRS Fresh Start Program isn’t wasn’t so much of a single program individual would apply for, but rather a series of changes the IRS made to the tax code to help tax debtors. One of the biggest aims was to make it easier for individuals that owed back taxes to pay off their debt and avoid getting a lien on their personal assets.

Some of the highlights of the IRS Fresh Start Program include:

- An increase in lien threshold from $5,000 to $10,000

- Ability to apply for lien withdrawal when owed taxes are under $25,000

Other areas of IRS debt forgiveness the Fresh Start Program affected include:

- Installment Agreements

- Offer in Compromises

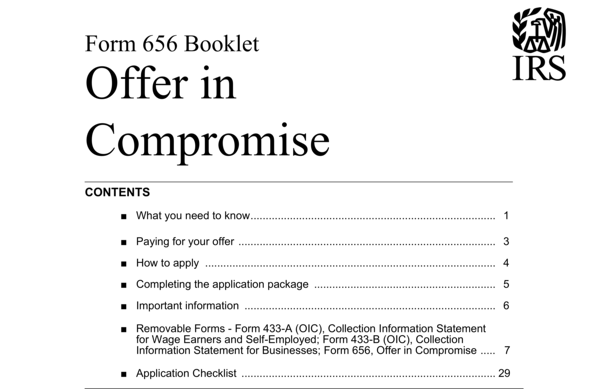

Offer In Compromise

An offer in compromise (OIC) is the closest thing the IRS offers in terms of debt forgiveness in the literal sense. You may qualify for an offer compromise if it’s determined you cannot realistically pay off your tax debate.

An OIC allows you to settle your debt for less than what you owe. The settlement amount is determined by what you can actually afford to pay. There are three factors that influence the IRS’s decision to accept an OIC.

Doubt as to Collectibility

When the IRS doubts a taxpayer will ever have the ability to pay off their outstanding tax debt in full, they may consider declaring Doubt as Collectibility on the account. They will determine this after a thorough examination of the individual’s assets and income.

Doubt as to Liability (DATL)

In a Doubt as to Liability compromise, you’ll have to prove that your assessed tax liability is wrong. It may be wrong due to examiner mistakes, missing information, or new information. In these cases working with a tax professional will give you the best chance of proving your case. If successful, the IRS will change the total tax owed to the appropriate amount.

Effective Tax Administration

In this case, the tax debtor shows the IRS they are unable under current circumstances to pay their debt, and doing so would cause undue hardship. Again, for this path to be successful working with a tax professional will give you the best odds of a successful OIC negotiation.

After submitting your OIC application, the IRS looks at your financial position – including income, assets, expenses, and living circumstances, and analyzes all the variables. They’ll determine your ability to pay what you owe in back taxes.

If you do qualify for an OIC it may make you eligible to have tax-adjacent costs reduced. This means you’ll also be able to negotiate settlements for penalties and interest.

Get a free consultation

We Are Committed To Finding SolutionsLearn MoreIRS Installment Agreements

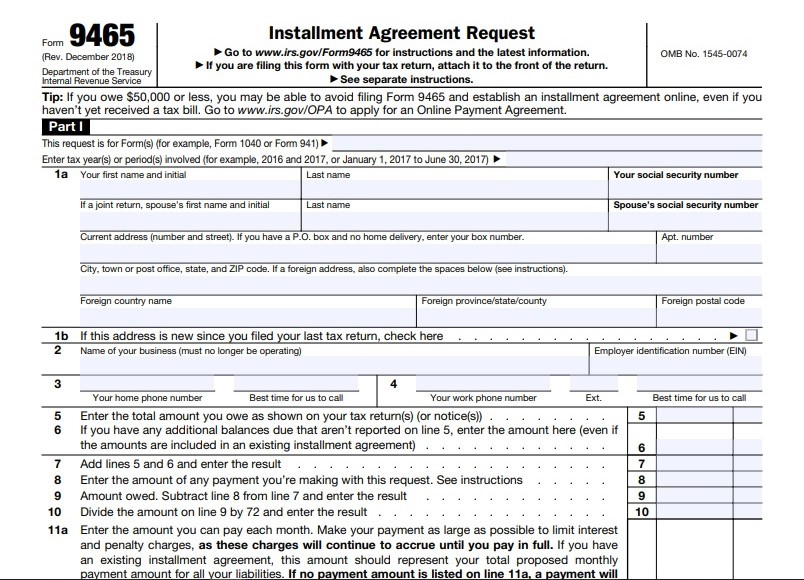

In most cases, taxpayers unable to pay in full or facing a tax debt will choose an installment agreement for their IRS tax debts.

One of the biggest benefits of an installment agreement is the IRS also suspends collection actions like wage garnishments, tax liens, or tax levies once your agreement has been accepted.

An installment agreement allows you to make monthly payments based on your income and the value of your assets. The aim is to make your payments affordable so you can pay them on time without a financial burden, and eventually eliminate your tax debt.

How Do You Qualify for an IRS Installment Agreement?

How Do You Qualify for an IRS Installment Agreement?

Not everyone automatically qualifies for an installment agreement. You must meet the following criteria to qualify:

- Get current with all filed tax returns

- You must disclose all assets

- Prove that you lack the adequate cash to pay off your tax debt by providing financial records

- Show that you’re unable to borrow the amount you owe using loans or refinancing options

- Demonstrate you lack adequate equity in retirement accounts to pay for the debt

Small Business Installment Agreements

Small Business Installment Agreements

It’s common for small business owners to get behind on their quarterly tax payments and end up with an end-of-the-year tax bill they can’t handle with one payment.

For these cases, the IRS offers a type of installment agreement called In-Business Trust Fund Express installments. To qualify, a business must owe less than $25,000 in payroll taxes and have filed all required tax returns.

These installment plans typically don’t require any form of financial verification or statement, making them easy to apply. If a business owes more than $10,000 but is still under the $25,000 threshold, they’ll be required to use a Direct Debit installment agreement.

Can Installment Agreements be Revoked?

Can Installment Agreements be Revoked?

Yes, they can. IRS programs have rules you must strictly follow to benefit. If you break the rules, the IRS will have no problem provoking the payment plan.

The three most common ways installment agreements get revoked:

Payment Default:

If you miss any of your payments, the IRS can exercise its right to revoke your agreement immediately. In most cases, they’ll first send you a notice or warning letter giving you 30 to 60 days to get up to date on your payments. If your agreement is revoked due to missed payments, you may have the chance to reinstate your plan by paying the outstanding balance.

Failure to File or Pay Future Tax Returns:

Each installment agreement is conditional based on your current and future returns and income taxes. If you fail to file or pay an upcoming return, the IRS will automatically revoke your installment agreement. For this reason, it’s critical you have a plan in place to stay on top of all future tax obligations.

False Information:

Giving the IRS false, inaccurate, or incomplete information during your negotiation process is cause for them to terminate your installment agreement. If you knowingly gave false information and they discover your deception, not only will your agreement be revoked, but you could face other penalties.

We Are Committed To Finding Solutions

Learn MoreCurrently Non-Collectible

You can think of currently non-collectible status as temporary relief, or a payment deferment period. It doesn’t forgive your IRS debt, but it does put your account into a status that stops IRS collection efforts.

CNC status allows taxpayers who are in financial hardship situations to defer paying their tax bill until their situation improves. If you’re unemployed for example, you may qualify for CNC status.

Like all of the IRS tax debt forgiveness options to get currently non-collectible status, you must first prove your case to the IRS. They will look through all of your accounts, assets, and even access your living expenses.

You will be asked to document your average monthly income and necessary living expenses. If it’s determined you’re able to use an installment agreement and avoid hardship the IRS will recommend that before granting CNC status.

Things to Know about Currently Non-Collectible Status

Things to Know about Currently Non-Collectible Status

- The IRS will take any tax refunds in future years until your debt is paid

- The IRS will typically file federal tax liens when individuals owe more than $10,000

- CNC status is not indefinite: the IRS reviews your financial situation every year or two to see if you can afford to get on an installment plan.

Innocent Spouse Relief

IRS innocent spouse relief is a form of IRS debt forgiveness that will clear your tax debt if you qualify. If you’re able to prove that your spouse, or former spouse, failed to report or underreported income without your knowledge, or fraudulently claimed deductions you can be fully relieved from that tax burden.

There are three types of spousal tax relief.

Separation of Liability Relief:

In this form of spousal relief the IRS splits the tax liability between you and your spouse. In this case, you’d only be responsible for the portion allocated to you.

Injured Spouse Relief:

In the case of injured spousal relief if your tax refund is taken to satisfy your spouse’s debt, such as child support for example, you may be able to get your money back through an injured spouse claim.

Equitable Relief:

Equitable relief is in most cases requested when you are ineligible for the other two types of relief. In an equitable relief scenario, the IRS must agree that it’s unfair to hold you liable for your spouse’s tax debt.

How to Qualify for Innocent Spouse Relief

How to Qualify for Innocent Spouse Relief

Like every other IRS debt forgiveness program, you must meet specific qualifications to receive the benefits. The IRS states that a taxpayer may qualify for Innocent Spouse Relief if all of the following requirements are met:

- The taxpayer filed a joint tax return for the year(s) in question.

- The tax liability resulted from erroneous items of the person with whom the taxpayer filed the joint return (such as unreported income or an incorrect deduction, credit, or basis).

- The taxpayer can show that they did not participate or possess any knowledge of the existence of the understated tax.

- Taking all facts and circumstances into account, it would be unfair to hold the taxpayer responsible for the tax debt.

- The taxpayer and their spouse (current or former) have not transferred any property to one another in an effort to defraud the IRS.

Not ready to talk to someone?

Let us email you some general information about our process.Learn MoreCan I Negotiate with the IRS Myself?

Yes, you can negotiate with the IRS yourself. However, there are good reasons most people choose to hire a tax professional.

Time

Time

The average wait time for a call to the IRS Automated Collections for Business (ACS-B) line is just over 70 minutes, and that’s if your call doesn’t get dropped. Add in the time spent calling back and talking with representatives, and it works out to around 108 minutes per call.

In addition to just getting in touch with an actual agent for help, you’ll spend a lot of time researching forms, getting questions answered on the correct way to fill the forms out, and keeping track of all your correspondence.

Deadlines

Deadlines

When you miss a deadline the IRS increases its collection efforts and adds on interest, fines, and other penalties. They may levy your accounts and start garnishing your wages. The longer a tax liability is not in a formalized IRS payment agreement, the more penalties and interest accrue.

Expertise

Expertise

The knowledge of an experienced professional is always valuable when facing unfamiliar territory – especially one that affects you financially. It is difficult to make sense of the notices the IRS sends, which forms to fill out, and how. When you’re working full-time or running a business, having to become a tax expert in your downtime is too overwhelming.

Why Work with a Tax Professional for IRS Debt Forgiveness?

Choosing to work with an experienced tax relief company like 20/20 Tax Resolution gives you the best chances of the most desirable outcome for your tax help situation. Your case is thoroughly reviewed by a team of tax professionals and all of your options are presented in an easy-to-understand way.

Once you choose the course of action your tax expert gets to work on your tax debt relief. You focus on your normal day-to-day and have peace of mind knowing you’re now in the process of getting your tax debt settled once and for all.

20/20 Tax Resolution are nationwide go-to experts when it comes to IRS debt forgiveness help. 20/20 Tax Resolution has helped over 32,000 businesses and individuals reach successful resolutions with their IRS and state tax liabilities.